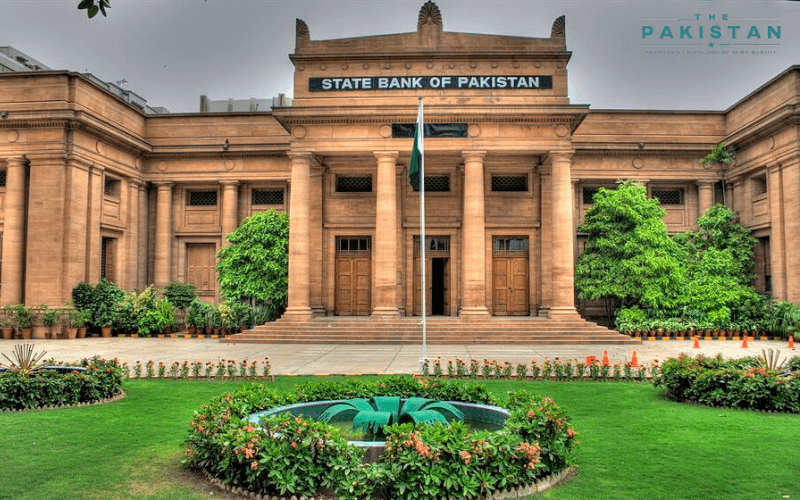

SBP extends deadline for debt deferment facility

The State Bank of Pakistan (SBP) on Wednesday extended the deadline for the debt deferment facility till September 30 allowing small and medium enterprises to defer payments on their loan principals.

“Considering the fact that Covid-19 pandemic is continuing to stress the cash flow of small and medium sized businesses and households, the SBP has decided to extend the Deferment of Principal Amount facility up till Sept 30,” the central bank said in a press release.

“This facility will however be available for Small & Medium Enterprise financing, consumer financing, housing finance, agriculture finance and micro-financing only.”

However, it added that the facility is not being extended to corporates and commercial borrowers since a significant amount of their loans and advances has already been deferred.

Moreover, It is expected that more businesses and households, who were not able to avail the facility, will benefit from this extension, the release added.

The debt deferment facility was announced by the SBP on Mar 26 to help the companies sustain the economic impact emanating from the Covid-19 pandemic and subsequent aftereffects on the corporates especially small and medium enterprises.

Announcing the scheme, the SBP had then said that “under this facility, businesses and households could request for the deferment of their loans and advances for a period of one year, albeit continuing to service the mark-up amount.”

Moreover, it added that the measure also ensured that the deferment of principal will not affect borrower’s credit history and such facilities will not be reported as restructured/rescheduled in the credit bureau’s data.

The deferment facility was helpful to at-risk livelihoods that were unable to pay their loans and interest amounts due to the pandemic.

This measure proved extremely helpful for borrowers and is evident from the fact that up till July 3, 2020, banks deferred Rs593 billion of principal amount of loans of over 359 thousand borrowers.

A very large number of borrowers— 95 per cent of total beneficiaries of this scheme, as of July 3, 2020 have been small borrowers including SMEs, consumer finance, and microfinance, the SBP added.