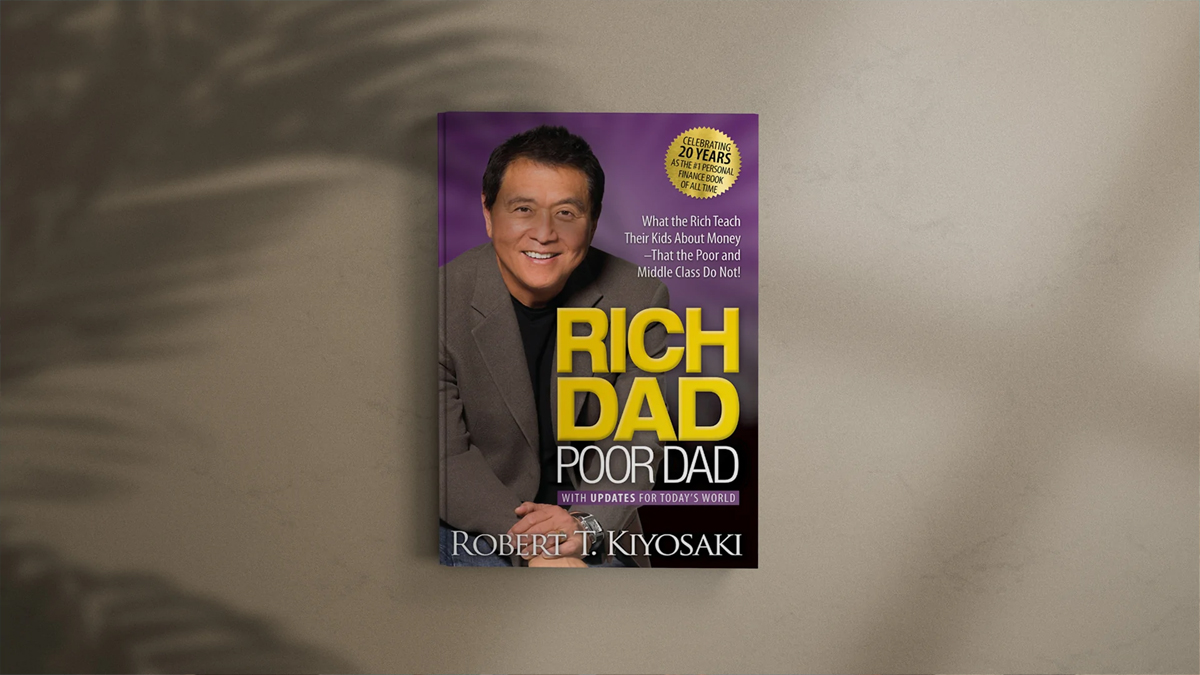

Books on Making Money

For anyone looking to improve their financial situation, Robert Kiyosaki’s “Rich Dad, Poor Dad” is a must-read. It’s not like other books on making money that give you a set of instructions and you just follow along on your own.

More than that, though, “Rich Dad, Poor Dad” provides excellent advice on how to raise a money-savvy offspring. The book explains that the difference between a wealthy and a poor mentality is all in one’s attitude toward money, and that developing a rich mentality is the key to financial success. Sadly, few of us received instruction in monetary acuity in our formative years.

Here are a few of the book’s most important lessons that you may apply immediately to improve your life.

Mistakes are Merely Lessons

If we make a mistake in school, we get punished for it. As a result, most of us spend our formative years actively avoiding situations where we could stumble and learn anything valuable. Successful people may learn a lot from their misfortune.

Moreover, if you listen to the advice of motivational speaker Dennis Waitley: Failures and errors do not exist; just learning.

Playing it Safe Keeps us Stuck

Life is full with perils from the moment we take our first steps as infants till the moment we breathe our last. That’s a key part of developing our skills and knowledge. Our parents and educators, unfortunately, do everything they can to shield us from danger.

Not taking any chances at all stunts our development and puts us in the same rut. Taking financial risks can pay off, but in the long run, complacency is the greater loss. The brave are rewarded in life.

Rather than trying to escape danger, it’s better to study as much as you can about it and use what you’ve learned. However, this does not make the dangers go away. What it boils down to is taking reasonable risks based on sound reasoning.

Study all you can about the money system

Our lives and our relationships are profoundly impacted by financial circumstances. Therefore, it is crucial that you learn as much as you can about money, such as how to make your money work for you. And how the economy itself functions.

Work for experience and satisfaction instead of working for money

Although it is necessary, money shouldn’t be the driving force behind our efforts. We shouldn’t work just for the paycheque, but also for the benefits of working and learning.

The old saying goes something like this: “Do what you love, and the money will follow.” Although this is not always the case, there is certainly some merit in trying to make our life count for something. When we do anything well, it gives us a sense of accomplishment, and when we feel a sense of accomplishment, we are more likely to work hard at it in the hopes of someday receiving monetary compensation for it.

Desire and Greed are Great Motivators

Humans have a tremendous capacity for desire and greed. When channeled constructively, they may provide fantastic ideas for generating income. Consistent with your principles, though. Make money your driving force by channeling your desire and greed.

Instead of Saying I Can’t Afford it, say, “How Can I Afford It?’

You can change lives with what you say. Select them carefully, and never discount their ability to affect the final result.

Formulate a question that is both encouraging and helpful in order to express your opinions. If you’re looking for answers, an inquiry is a terrific tool, but remember to keep things upbeat and constructive. Say “how can I afford it” instead of “I can’t afford it.”

Read More | GB government tripled the Educational expenditure

Read More | Android App for Teachers’ Attendance

Take on the identity of the person you want to be

Putting on an act to become who you see yourself to be is not the same as “fake it till you make it,” despite the similarity in tone. The key to experiencing the comfort and confidence of riches is to adopt the mindset of a wealthy person.

Taking on the persona of a wealthy person might seem like a daunting task if you’ve never experienced luxury and don’t have any affluent friends or family members. Now picture what it would be like to be wealthy, with no financial worries and the freedom to do anything you want with your life.

Learn about investing before you start investing

Investing, not saving, is the path to financial security and success. In which areas, though, should you put your money? When people suddenly find themselves in possession of some extra cash, they often fall prey to those offering to quadruple their money in a short period of time through various “get rich quick” schemes. Get as much education as possible about investing before you put any money into the market.

Be Selective about What you Feed your Mind

You become what you think about, just as you are what you consume. Put only upbeat, uplifting ideas into your head. Keep your brain active by avoiding mindless TV. Educate and inspire yourself by reading books. Enjoy some mind-nourishing video content.

The things you expose your intellect to will either help it grow or hold it back. Maintain a development attitude by “feeding” on the right things.

Surround Yourself with People with a Growth Mindset

However “strong” you may believe yourself to be, you should never discount the impact of your social circle on your actions. This has been demonstrated by several studies.

Associating with others whose outlook and lifestyle you respect is an effective way to bring about lasting changes in your own outlook and outlook on life. You may count on absorbing some of that energy.

Pay Yourself First

The majority of the population lives paycheck to paycheck, with little savings to speak of. Most people don’t have much extra cash at the end of the month.

Putting aside 10–20% of your paycheck right after you get it can have a profound impact on your financial future.

Action Always Beats Inaction

The Amount of Help You Give Yourself You may learn how to become wealthy via books, classes, conferences, and even YouTube videos. You, and only you, can fix this. And you do this by acting instantly. The moment is now, therefore there’s no use in waiting for it.

So, what can you do right now to begin developing a mindset conducive to financial success? Read up on financial planning? Do you want to start saving? Get yourself an app that will help you budget your money. Get your funds into the market.